World

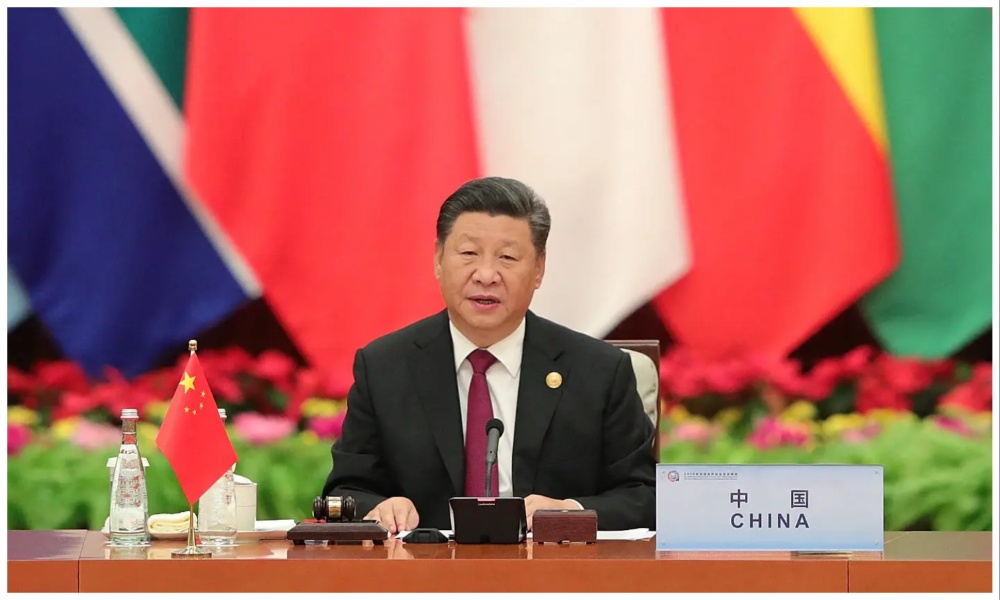

World’s poorest countries pushed to brink of collapse under China debt

At least a dozen poor countries are buckling under the weight of hundreds of billions of dollars in debt, most of which is owed to China.

A recent analysis, carried out by the Associated Press, found that for a dozen countries, paying back their debt is consuming a growing amount of their tax revenue needed to keep basic services going.

Among the countries analyzed was Pakistan, Kenya, Zambia, Laos and Mongolia and it was found that paying back their debt is also draining foreign currency reserves that these countries use to pay interest on the loans – leaving some with just months before that money is gone.

AP reported that behind the scenes is China’s reluctance to forgive debt and its extreme secrecy about how much money it has loaned and on what terms, which has kept other major lenders from stepping in to help.

According to World Bank data analyzed by Statista recently, countries heavily in debt to China are mostly located in Africa, but can also be found in Central Asia, Southeast Asia and the Pacific.

And, Statista reports that the new Belt and Road Initiative, which finances the construction of port, rail and land infrastructure, has created much debt to China for participating countries, specifically poor countries.

As of March last year, 215 cooperation documents had been signed with 149 countries on the initiative.

Countries in AP’s analysis meanwhile had as much as 50% of their foreign loans from China and most were devoting more than a third of government revenue to paying off foreign debt.

Two of them, Zambia and Sri Lanka, have already gone into default, unable to make even interest payments on loans financing the construction of ports, mines and power plants.

In Pakistan, millions of textile workers have been laid off because the country has too much foreign debt and can’t afford to keep the electricity on and machines running, AP stated.

In Kenya, the government has held back paychecks to thousands of civil service workers to save cash to pay foreign loans. The president’s chief economic adviser tweeted last month, “Salaries or default? Take your pick.”

The study also found that since Sri Lanka defaulted a year ago, a half-million industrial jobs have vanished, inflation has risen by 50% and more than half the population in many parts of the country has fallen into poverty.

The study found that experts predict that unless China begins to soften its stance on its loans to poor countries, there could be a wave of more defaults and political upheavals.

AP’s report stated that a case study of how it has played out is in Zambia, a landlocked country of 20 million people in southern Africa that over the past two decades has borrowed billions of dollars from Chinese state-owned banks to build dams, railways and roads.

While the loans boosted Zambia’s economy, they also raised foreign interest payments so high that there was little left for the government, forcing it to cut spending on healthcare, social services and subsidies to farmers for seed and fertilizer.

In the past under such circumstances, big government lenders such as the U.S., Japan and France would work out deals to forgive some debt, with each lender disclosing clearly what they were owed and on what terms so no one would feel cheated.

But China didn’t play by those rules, AP reported. It refused at first to even join in multinational talks, negotiating separately with Zambia and insisting on confidentiality that barred the country from telling non-Chinese lenders the terms of the loans.

By late 2020, Zambia was unable to pay the interest and defaulted, setting off a cycle of spending cuts and deepening poverty.

Since then, inflation in Zambia has increased by 50%, unemployment has hit a 17-year high and the nation’s currency, the kwacha, has lost 30% of its value in just seven months. AP also found that 3.5 million Zambians are now not getting enough food.

AP reported that a few months after Zambia defaulted, researchers found that the country owed $6.6 billion to Chinese state-owned banks, double what many thought at the time and about a third of the country’s total debt.

China’s unwillingness however to take big losses on the hundreds of billions of dollars it is owed, as the International Monetary Fund and World Bank have urged, has left many countries on a treadmill of paying back interest, which stifles the economic growth that would help them pay off the debt.

For Pakistan, its foreign cash reserves have plunged more than 50%, according to AP’s analysis, while in nine of the 12 countries analyzed, foreign cash reserves have dropped on average of 25% in just one year.

Based on this, Pakistan for example has only two months left of foreign cash to pay for food, fuel and other essential imports if it does not get a bailout. Other countries, such as Mongolia, have eight months left.

AP found that last month, Pakistan was so desperate to prevent more blackouts that it struck a deal to buy discounted oil from Russia, breaking ranks with the US-led effort to shut off Vladimir Putin’s funds.

In Sri Lanka, rioters poured into the streets last July, setting homes of government ministers aflame and storming the presidential palace, sending the leader tied to onerous deals with China fleeing the country.

China has however disputed the idea that Beijing is an unforgiving lender and said in a statement that the Federal Reserve was to blame.

It said that if it is to accede to IMF and World Bank demands to forgive a portion of its loans, so should multilateral lenders, which it views as US proxies.

“We call on these institutions to actively participate in relevant actions in accordance with the principle of ‘joint action, fair burden’ and make greater contributions to help developing countries tide over the difficulties,” the statement said.

But China’s approach to lending is widely considered more transactional and criticized as “opaque” and analysts see Beijing’s desire to access oil, minerals and other commodities as the driving force behind Chinese lenders being less prone to applying strict conditions in helping governments finance roads, bridges and railroads – so as to unlock those resources.

Just last month, US Treasury Secretary Janet Yellen told lawmakers: “I’m very, very concerned about some of the activities that China engages in globally, investing in countries in ways that leave them trapped in debt and don’t promote economic development.”

“We are working very hard to counter that influence in all of the international institutions that we participate in,” she said.

Since 2017, China has become the world’s largest official creditor, surpassing the World Bank, IMF and 22-member Paris Club combined, Brent Neiman, a counselor to Yellen, said late last year.

Politico meanwhile reported earlier this month that China’s financing of projects in other countries between 2000 and 2017 totaled more than $800 billion, most of that in the form of loans.

But for some poor countries struggling to repay China, they now find themselves stuck in a kind of loan limbo: China won’t budge in taking losses, and the IMF won’t offer low-interest loans if the money is just going to pay interest on Chinese debt.

World

Putin suggests temporary administration for Ukraine to end war

Russian President Vladimir Putin suggested Ukraine be placed under a form of temporary administration to allow for new elections and the signature of key accords to reach a settlement in the war, Russian news agencies reported early on Friday.

Putin’s comments, during a visit to the northern port of Murmansk, come amid U.S. attempts to forge a settlement to the conflict by re-establishing links with Russia and engaging with both Moscow and Kyiv, in separate talks. The Kremlin leader said he believed U.S. President Donald Trump truly wanted peace, Reuters reported.

Russia’s invasion of Ukraine in February 2022 has left hundreds of thousands of dead and injured, displaced millions of people, reduced towns to rubble and triggered the sharpest confrontation for decades between Moscow and the West.

Putin’s suggestion of a temporary administration appeared to address his long-held complaint that Ukraine’s authorities are not a legitimate negotiating partner as President Volodymyr Zelenskiy has stayed in power beyond the May 2024 end of his mandate.

“In principle, of course, a temporary administration could be introduced in Ukraine under the auspices of the U.N, the United States, European countries and our partners,” Putin was quoted as saying in talks with seamen at the port.

“This would be in order to hold democratic elections and bring to power a capable government enjoying the trust of the people and then to start talks with them about a peace treaty.”

He said Trump’s efforts to proceed with direct talks with Russia – in contrast with his predecessor Joe Biden, who shunned contacts – showed the new president wanted peace.

“In my opinion, the newly elected president of the United States sincerely wants an end to the conflict for a number of reasons,” the agencies quoted him as saying.

A White House National Security Council spokesperson, asked about Putin’s remarks on temporary administration, said governance in Ukraine was determined by its constitution and the people of the country.

There was no immediate comment from Ukraine.

European leaders have pressed on with their own efforts, pledging after a meeting in Paris on Thursday to strengthen Kyiv’s army to ensure it was the cornerstone of future security in Ukraine.

France and Britain tried to expand support for a foreign “reassurance force” in the event of a truce with Russia, although Moscow rejects any presence of foreign troops in Ukraine.

UKRAINE REJECTS NOTION OF ILLEGITIMACY

Zelenskiy has rejected any notion questioning his legitimacy, saying Ukraine is barred by law from holding elections under martial law and holding a poll in wartime conditions would in any case prove impossible.

Zelenskiy has repeatedly accused Putin in recent days of wanting to press on with the conflict.

The Trump administration has proposed a new, more expansive minerals deal with Ukraine, according to three people familiar with the ongoing negotiations and a summary of a draft proposal obtained by Reuters.

Trump has said a minerals deal will help secure a peace agreement by giving the United States a financial stake in Ukraine’s future.

In his comments, Putin said Russia was steadily moving forward to achieving the goals it had set out in its Ukraine operation.

Russia, Putin said, was in favour of “peaceful solutions to any conflict, including this one, through peaceful means, but not at our expense”.

“Throughout the entire line of military contact, our troops are holding the strategic initiative,” he said.

“We are gradually – perhaps not as quickly as some might like – but still persistently and with confidence moving towards achieving the goals set out at the beginning of this operation,” the agencies quoted him as saying.

More than three years after launching their full-scale invasion of Ukraine, Russian forces now hold about 20% of the country, with Moscow declaring four regions annexed. Its forces have also recovered much of the territory it initially lost in a Ukrainian incursion last August into its western Kursk region.

Putin praised the efforts in seeking a solution from the BRICS grouping it promotes as an alternative to traditional alliances – singling out China and India for praise.

He said Russia was ready to cooperate with many countries, including North Korea, to help end the war.

Western and Ukrainian sources say more than 11,000 North Korean troops have been sent to bolster Russian forces in the Kursk region, although Moscow has not confirmed this.

Putin said Russia was also ready to work with Europe, but adding that Europe “conducts itself in inconsistent fashion”.

European countries, he said, were trying “lead us around by the nose, but it’s okay, we’ve become used to it. I hope that we won’t make any mistakes based on excessive trust in our so-called partners.”

World

Secretive Chinese network tries to lure fired US federal workers, research shows

Researcher identifies “network of fake consulting and headhunting firms”

A network of companies operated by a secretive Chinese tech firm has been trying to recruit recently laid-off U.S. government workers, according to job ads and a researcher who uncovered the campaign, Reuters reported Wednesday.

Max Lesser, a senior analyst on emerging threats with the Washington-based think tank Foundation for Defense of Democracies, said some companies placing recruitment ads were “part of a broader network of fake consulting and headhunting firms targeting former government employees and AI researchers.”

Little information is publicly available on the four consultancies and recruitment companies allegedly involved in the network, which in some cases shared overlapping websites, were hosted on the same server, or had other digital links, according to Reuters’ reporting and Lesser’s research.

The four companies’ websites are hosted at the same IP address alongside Smiao Intelligence, an internet services company whose website became unavailable during Reuters’ reporting.

Reuters could not determine the nature of the relationship between Smiao Intelligence and the four companies.

The news agency’s attempts to track down the four companies and Smiao Intelligence ran into numerous dead-ends including unanswered phone calls, phone numbers that no longer work, fake addresses, addresses that lead to empty fields, unanswered emails and deleted job listings from LinkedIn.

Lesser, who uncovered the network and shared his research with Reuters ahead of publication, said the campaign follows “well-established” techniques used by previous Chinese intelligence operations.

“What makes this activity significant,” he said, “is that the network seeks to exploit the financial vulnerabilities of former federal workers affected by recent mass layoffs.”

Reuters could not determine if the companies are linked to the Chinese government or whether any former federal workers were recruited.

Asked about the research, three intelligence analysts told Reuters the network appeared to be a prime example of how foreign-linked entities are trying to gather intelligence from staff fired or forced into retirement by President Donald Trump and billionaire tech tycoon Elon Musk’s Department of Government Efficiency.

A spokesperson for the Chinese Embassy in Washington told Reuters in an email that China was unaware of any of the entities allegedly involved in the campaign and Beijing respects data privacy and security.

A White House spokesperson said China was constantly trying to exploit the United States’ “free and open system” through espionage and coercion.

“Both active and former government employees must recognize the danger these governments pose and the importance of safeguarding government information,” the spokesperson said.

One of the companies in the network, RiverMerge Strategies, bills itself on its website as a “professional geopolitical risk consulting company” and posted two since-deleted job listings on its since-removed LinkedIn page in mid-February.

One ad that sought a “Geopolitical Consulting Advisor” with experience with government agencies, international organizations, or multinational corporations, displayed that it had more than 200 applications, according to a screenshot of the LinkedIn post.

The other sought a human resources specialist who could “utilize a deep understanding of the Washington talent pool to identify candidates with policy or consulting experience,” and “leverage connections to local professional networks, think tanks, and academic institutions.”

World

Russian missile attack wounds 88 in Ukraine’s Sumy, officials say

Zelenskiy said Russia was “the only entity prolonging this war and tormenting both our people and the entire world.

A Russian missile attack hit a densely-populated district of Ukraine’s northeastern city of Sumy, wounding 88 people, including 17 children, on Monday as ceasefire talks, ploughed on, officials said.

Regional governor Volodymyr Artiukh announced the latest casualty toll on national television. He said many more children had escaped injury as they had been evacuated to air raid shelters, Reuters reported.

“They were in the area in a densely-populated area hit by the enemy strike,” Artiukh told the television.

“Two schools fell within the impact zone. I was present when our rescuers cleared the locations where the children were. They were in protective structures. All the children were rescued and evacuated to a safe place.”

Several high-rise residential blocks in the city centre were also damaged, read the report.

Artiukh had earlier spoken in a video that he said was shot at the scene with heavy black smoke, fires and a car with shattered windows in the background. Smoke also rose from the upper floors of a five-storey residential block nearby.

Ukrainian President Volodymyr Zelenskiy deplored the attack in his nightly video address as the latest example of “losses, pain and destruction, something Ukraine never wanted.”

The missile struck the city as Russian and U.S. officials met in Saudi Arabia to discuss a possible ceasefire.

Zelenskiy said Russia was “the only entity prolonging this war and tormenting both our people and the entire world.

“To force Russia into peace, strong measures and decisive actions are needed,” he said. “We are ready to support every strong initiative that makes diplomacy more effective.”

Foreign Minister Adrii Sybiha said Moscow was speaking of peace “while carrying out brutal strikes on densely populated residential areas in major Ukrainian cities.”

“Instead of making hollow statements about peace, Russia must stop bombing our cities and end its war on civilians,” Sybiha said.

Acting Sumy mayor Artem Kobzar said on Telegram an industrial facility was attacked but did not name it.

Sumy, about 30 km (20 miles) from the Russian border, comes under constant drone and missile strikes from Russia.

-

International Sports4 days ago

International Sports4 days agoIPL 2025: Sunrisers on a batting rampage; triumph over Rajasthan Royals

-

Latest News4 days ago

Latest News4 days agoEU says girls’ education crucial for Afghanistan’s long-term prosperity

-

Sport4 days ago

Sport4 days agoACB names Afghanistan A squad for tri-nation series

-

Latest News5 days ago

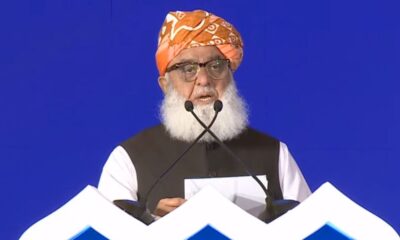

Latest News5 days agoPakistan’s mistakes played significant role in rise of terrorism: Maulana Fazl-ur-Rehman

-

Latest News4 days ago

Latest News4 days agoUzbekistan sends essential food aid to Afghanistan

-

International Sports3 days ago

International Sports3 days agoIPL 2025: Last over drama; Ashutosh Sharma clinches win for Delhi Capitals

-

Sport3 days ago

Sport3 days agoAfghanistan eliminated from Asian Beach Soccer Championship

-

Regional3 days ago

Regional3 days agoEgypt makes new proposal to restore Gaza truce as Israeli strikes kill 65